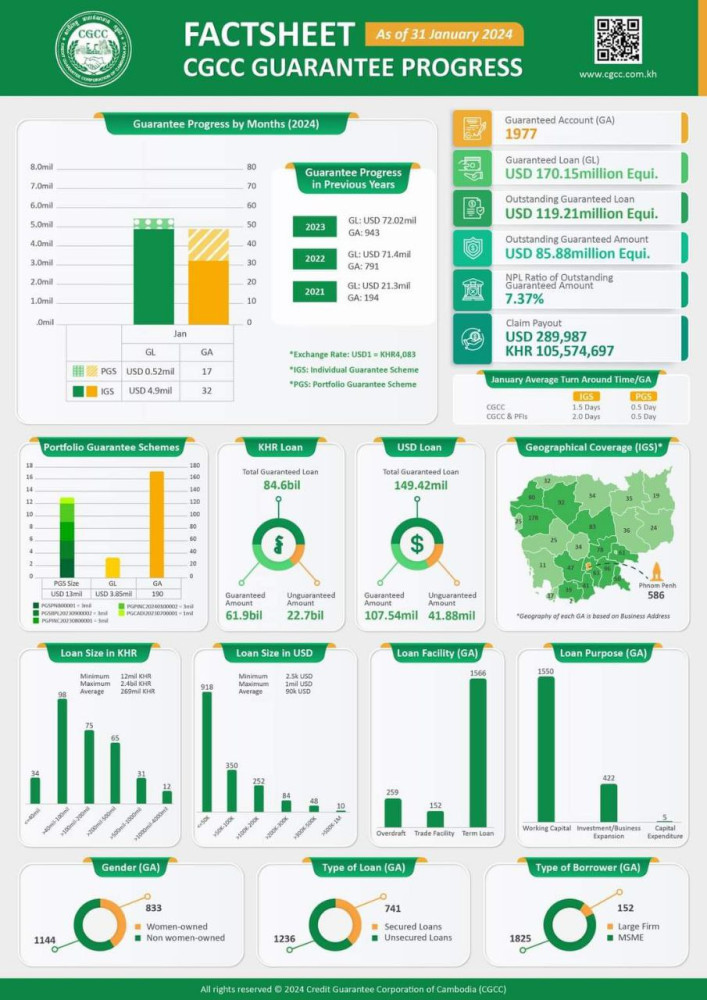

PHNOM PENH: The Credit Guarantee Corporation of Cambodia (CGCC) has extended crucial support to almost 2,000 businesses by issuing $170 million in credit guarantees as of January 2024. This initiative aims to provide working capital and facilitate expansion efforts.

According to a CGCC factsheet released on February 20th, the outstanding guaranteed loan amount currently stands at $119 million, while the outstanding guaranteed amount is $85.8 million. Notably, among the beneficiaries, 1,854 are micro, small, and medium enterprises (MSMEs), while 154 are larger businesses. Additionally, 833 of the supported businesses are women-owned.

The CGCC scheme partners with 27 financial institutions to offer loans for working capital investment and business expansion to SMEs. Established in November 2020 with a $200 million state budget, the CGCC plays a pivotal role in promoting financial inclusion and fostering SME growth in Cambodia.

Mey Vann, Secretary of State at the Ministry of Economy and Finance, commended the smooth loan distribution, emphasizing its positive impact on entrepreneurship and financial inclusion. He further highlighted the CGCC's significant contribution in supporting SMEs during challenging times like the COVID-19 pandemic and the current inflationary pressures, ensuring access to much-needed credit for business operations.